01

a little about us

Who we are

Welcome to Zaka Finance, your gateway to financial inclusion and empowerment in Africa.Now you can finally access financial services, where you are only charged for sending and receiving money, nothing else. We believe that everyone deserves access to basic financial services, regardless of their banking status. With our innovative digital wallet, we are revolutionising the way financial services are accessed and utilised.

Our digital wallet is designed to provide a seamless and user-friendly experience, allowing the unbanked, underbanked, and underserved population to save, transact, and access credit easily.

02

What we aim to achieve

Why we exist

Zaka’s digital wallet addresses the typical challenges faced by the unbanked, underbanked, and underserved population in Africa’s informal markets:

Limited Access to Cheap Capital: We offer affordable credit options within the digital wallet, providing users with access to much-needed funds for business growth and personal financial needs.

High Cost of Accessing Financial Services: Our digital wallet eliminates the high fees associated with traditional banking, enabling users to transact, save, and manage their finances without incurring excessive costs.

Lack of Formal Financial Identity: We help individuals establish a formal financial identity by leveraging their digital wallet usage and generating financial data. This empowers them with a credible financial track record, making it easier to access credit and other financial services in the future.

By tackling these challenges, Zaka’s digital wallet aims to promote financial inclusion and empower the unbanked, underbanked, and underserved population in Africa’s informal markets. We provide primary financial services, affordable credit, and the means to build a formal financial identity, unlocking new opportunities and improving financial well-being for individuals and communities.

Security0%

Reliability0%

Efficiency 0%

Application Design0%

03

target market

Who we exist for

Our digital wallet and financial services cater to:

Small business: owners in the informal sector, micro-entrepreneurs, street vendors, small-scale farmers, and artisans who operate businesses in the informal sector. challenges accessing credit, managing cash flow, and tracking their finances.

Gig workers: freelancers, independent contractors, and individuals engaged in the gig economy. in various sectors such as ride-hailing, delivery services, creative industries, and more.

Migrant workers: who need secure and affordable remittance services, includes domestic workers, construction workers, and individuals working in service industries, often needing secure and affordable remittance services to send money back to their families and access banking.

Students: managing their expenses, pursuing higher education within their own countries or abroad, rely on financial support from their families, and managing their expenses, receiving funds, and making payments.

Underserved individuals: in remote or underserved areas, where access to banking infrastructure is limited, facing geographic barriers, high costs associated with traditional banking, and lack of financial inclusion.

04

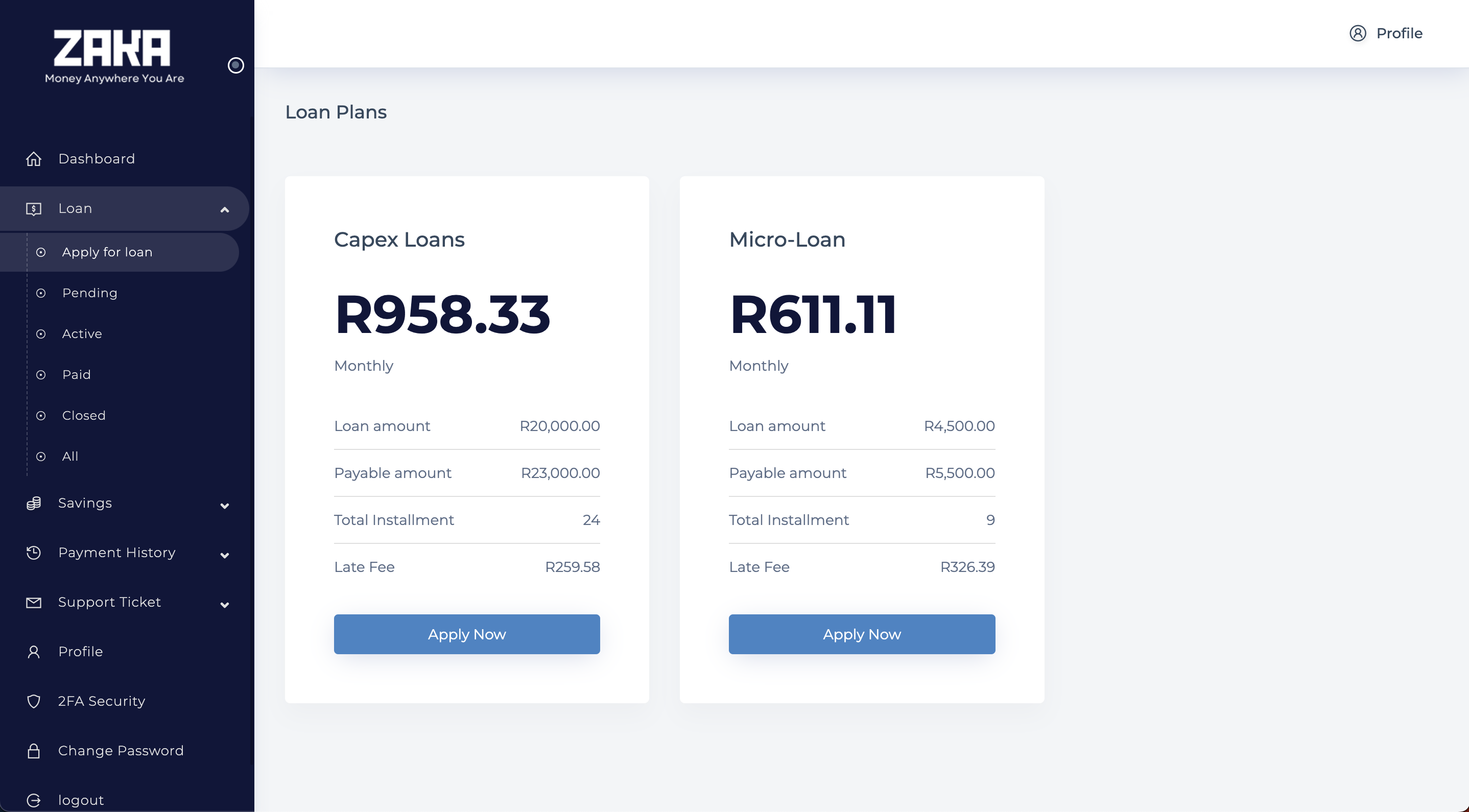

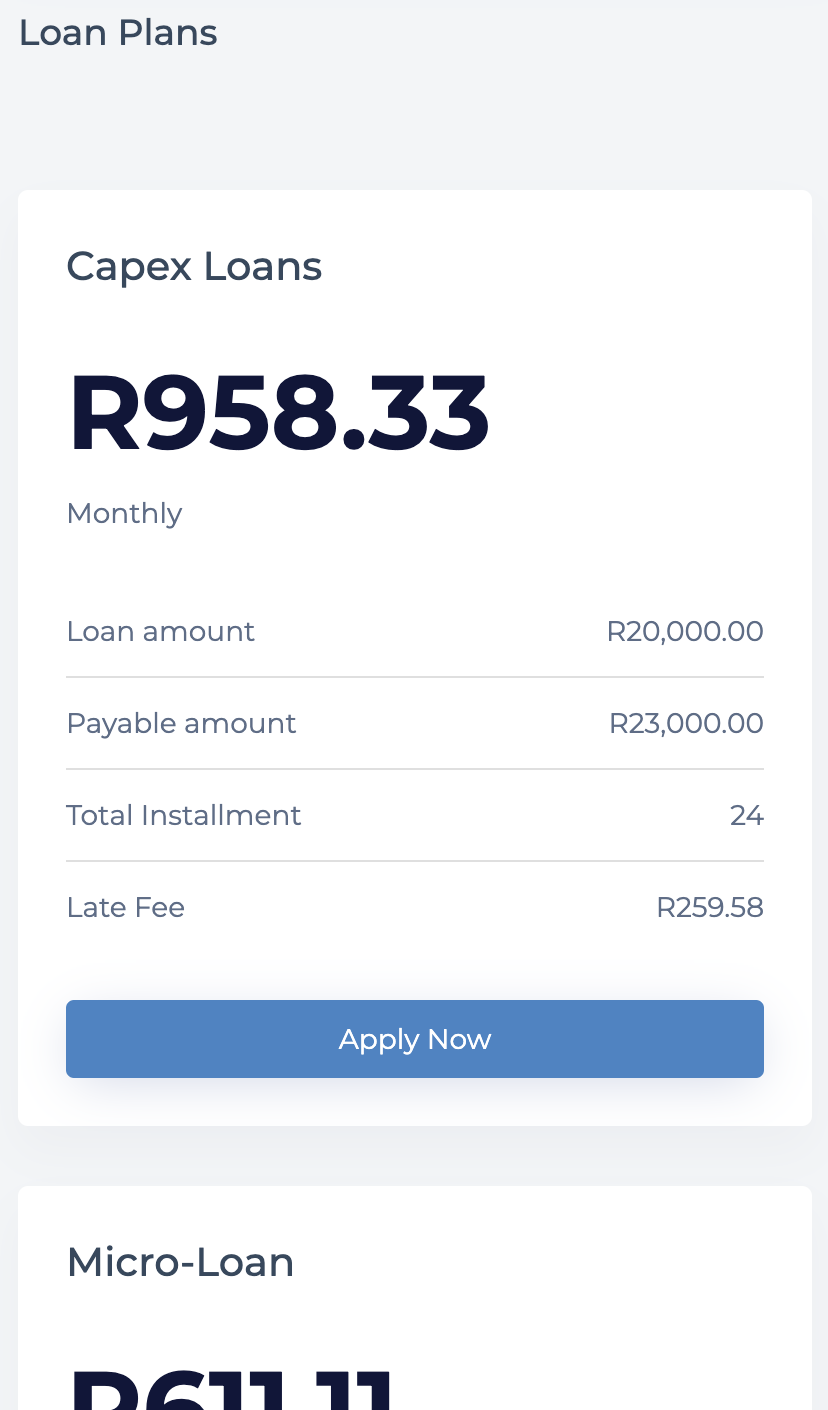

functionality

How it works

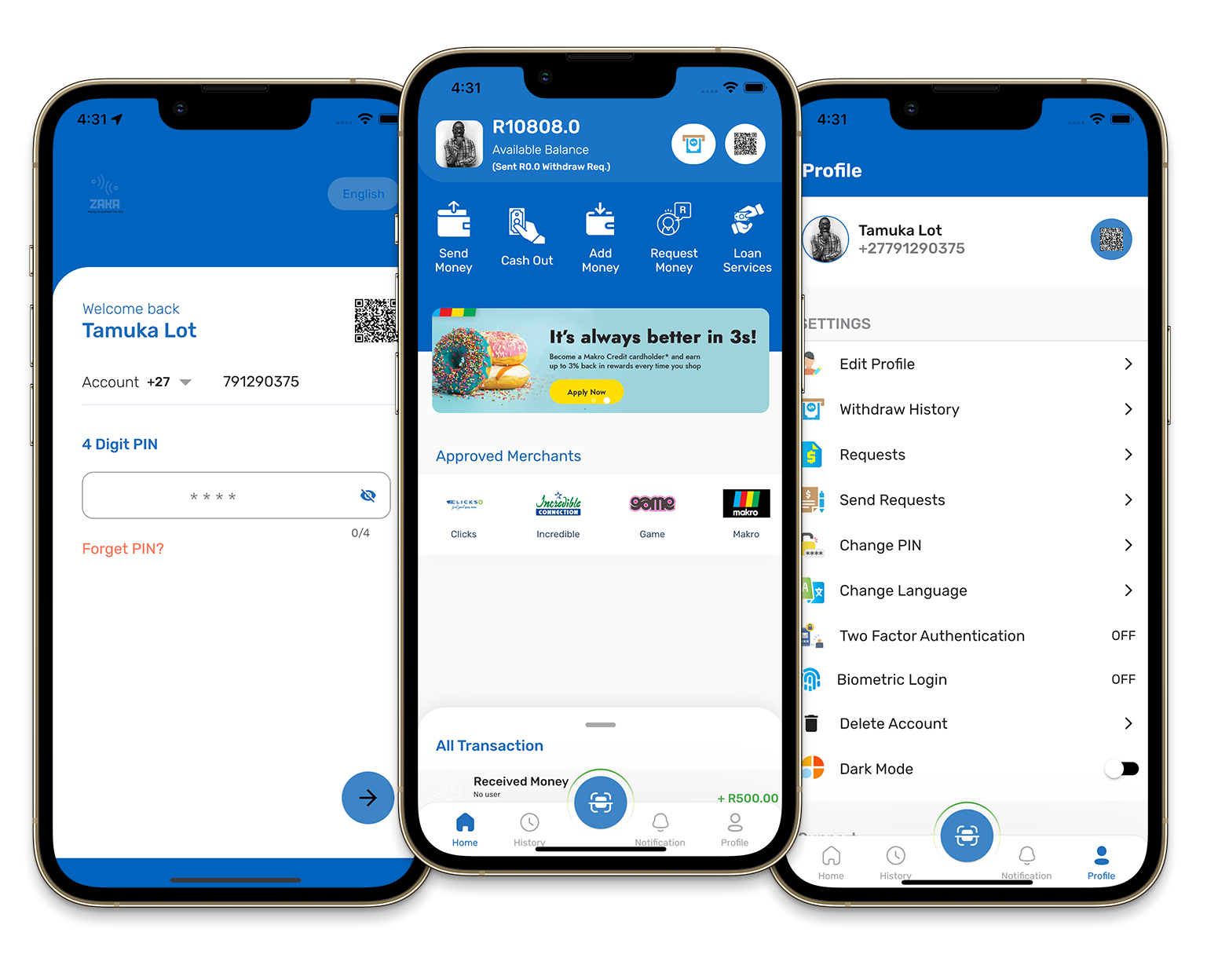

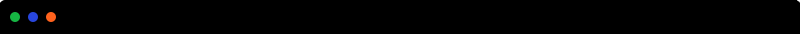

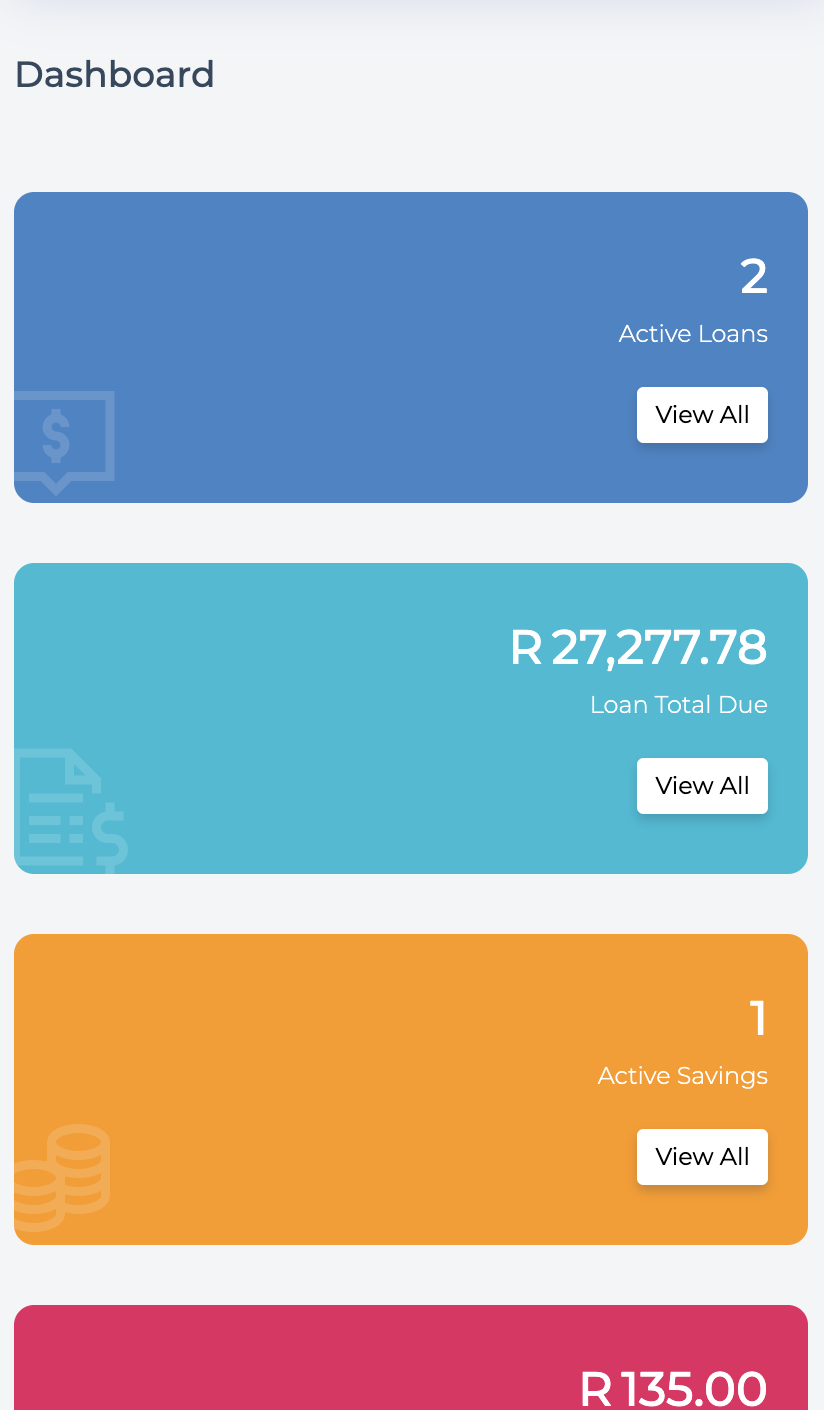

Neo-Banking Facility

Say goodbye to traditional banking hassles. Our digital wallet offers a neo-banking facility that allows you to:

● manage your finances efficiently, completely free of charge.

● track your expenses, view your transaction history, and monitor your savings effortlessly.

Peer-to-Peer Transactions

Low-Cost, Immediate Remittance Payments, sending and receiving money from anywhere in the world has never been easier.

● securely transfer funds from anywhere in the world to your friends, family, or business associates with just a few taps on your smartphone.

● Pay only a small percentage for these transactions, ensuring affordability and convenience.

Virtual Card for Tap and Pay

Our wallet comes with a virtual card that enables you to make contactless payments with ease.

● Simply add your virtual card to your smartphone's digital wallet and tap to pay at supported merchants.

● It's quick, secure, and hassle-free, making your daily transactions a breeze.

Physical Visa Card

In addition to the virtual card, we also issue a physical Visa card

● Giving you the freedom to make purchases at millions of locations worldwide. Whether you're shopping online or at a physical store, our physical card ensures that you're always in control of your finances.

Low-Interest Lending

We empower our users to become lenders and borrowers within our platform. As a lender,

● you can provide financial assistance to others in need while earning competitive interest rates.

● On the other hand, you can borrow money from our liquidity pool and access quick transparent and low interest credit.

05

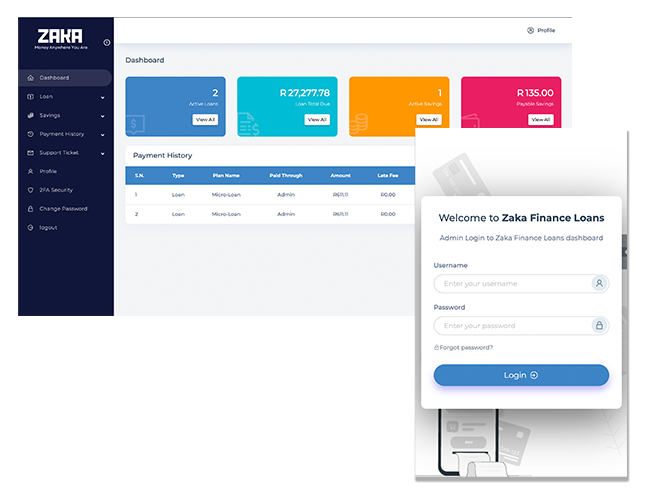

get it now

Download the app

Our transparent and fair lending system ensures a win-win situation for all.

At Zaka Finance, we are committed to driving financial inclusion and unlocking economic opportunities for all Africans. Join our community today and experience a new era of accessible, convenient, and empowering financial services. Together, we can build a brighter and more prosperous future.

Download the app now! and take control of your financial destiny.